What is Marginal Tax Rate?

Formula to calculate Marginal Tax Rate

What is Marginal Tax Rate?

The marginal tax rate is the rate at which the last dollar of income is taxed. Such a rate therefore represents what tax rate is applied on the highest portion of an individual’s or business income, and the progressive system taxes higher income levels at higher rates.

Example of Marginal Tax Rate: If a person’s income is taxed in various brackets, then the last $10,000 taxed at a 30% rate, then 30% is their marginal tax rate.

Difference Between Effective Tax Rate and Marginal Tax Rate

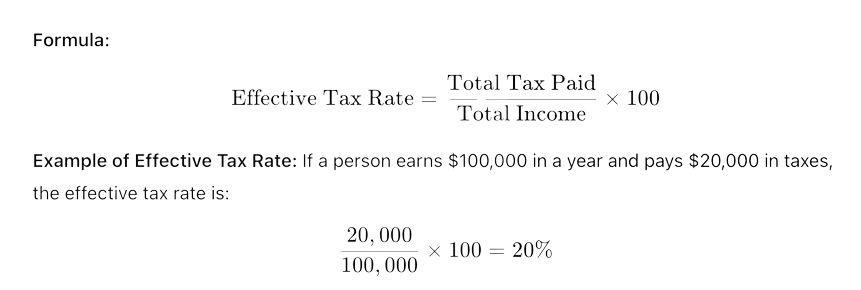

Definition: Effective tax rate is defined as total tax as a percent of total income. It is the tax payable on total income, whereas the marginal tax rate is the tax rate applied to the last portion of income.

Purpose: Effective tax rate helps to calculate the average tax burden, while marginal tax rate determines the tax rate for every dollar earned beyond the previous one.

Impact: The effective tax rate is usually lower than the marginal tax rate because not everything is taxed at a top rate.

The United States has a progressive tax system. What this means is the more money you earn, the more income tax you will pay. There are currently seven tax brackets ranging from 10% to 37%.

If you are single and earn $35,000 per year, your tax rate is 12%. If you are single and earn $520,000 you are in the top bracket which is 37%. These rates are Marginal Rates, and this is what most people are referring to when they say what their income tax rate is. However, this is where the confusion begins.

Marginal rates apply to each additional level of income earned. Meaning the first level of income is taxed at the lowest rate and this increase as your income increases. This illustration shows how a single taxpayer earning $100,000 works.

| Tax Bracket | Amount | Tax |

|---|---|---|

| 10% Bracket on the first | $9,950 | $995.50 |

| 12% Bracket on (40,525 – $9,950) | $30,750 | $3,669 |

| 22% Bracket on (86,375 – 40,525) | $45,850 | $10,087 |

| 24% Bracket on (100,000 – $86,375) | $13,625 | $3,270 |

| Total Tax | $18,021.50 | |

In this case, the Marginal rate was 24% But the Effective rate was 18%!

This example did not include Capital Gains Tax – an only tax on earned income.

Capital Gains are taxed differently

Short Term (less than one year) is treated as normal income.

Long Term (longer than one year) taxed at 0%, 15% and 20%.

Although most people talk about their Marginal Rate it is the Effective Rate that really affects your pocketbook.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.