Table of Contents

Save thousands each year, and gain control of what's yours.

Join our newsletter

to get trending content!

The common mistakes most of us make while saving for retirement is not calculating the rate of inflation and contingencies like long-term illness or accidents, which can drastically cut off your income flow.

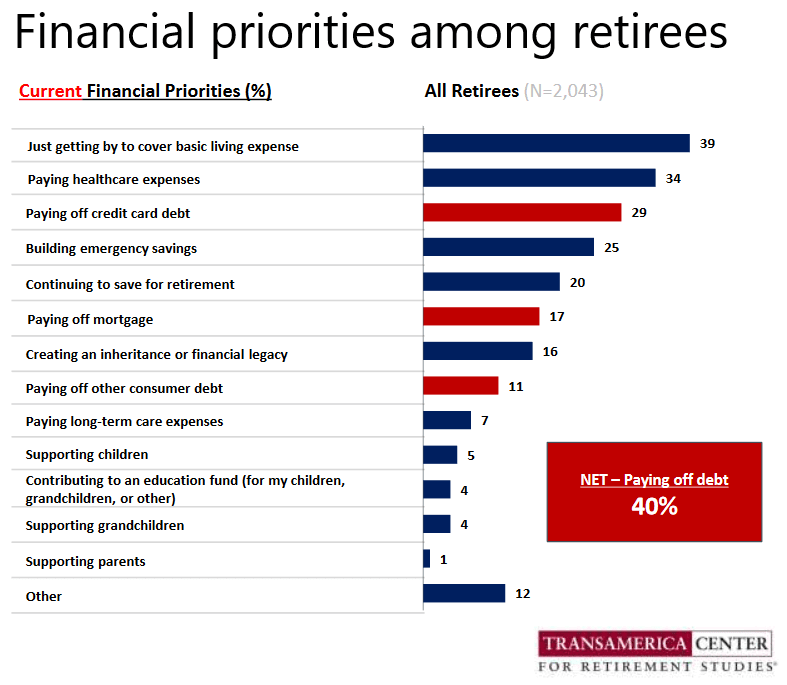

The major reasons why our retirees are suffering from debt are a lack of planning and a prolonged economic crisis, which has drastically reduced job opportunities that they could try out post-retirement.

To eliminate the chances of such a scenario happening to you after retirement, take a few precautionary steps and the suggestions of an experienced financial advisor, which will ensure a debt-free retirement.

While planning for retirement, try to gauge your likely monthly income and expenditure during that period. Think how you will manage if by chance someone in the family falls seriously ill or has an accident. Seems depressing, but quite a possible scenario, will you have insurance to manage expenses?

On the other hand, do you have a tendency to go overboard with credit cards? Start curbing this habit once you are nearing the other side of forty as this will become a major cash burner after retirement. A recent report by Survey of Consumer Finances has stated that nearly 50 per cent of homes headed by a retired person have credit card related debt. If that does not scare you, then nothing will.

Is it better to paying off debt before retirement?

The answer is, take one step at a time. Below are the few things you should consider before you retire.

Is it better to pay off the mortgage or save?

If by the age of mid-forties, you have still not bought a house in any town or city, chances are you will never stay in a place too long. Do not waste your time in buying one now unless you can settle the entire amount before you retire. Staying in a rented or leased accommodation is no problem at all as several people live a tension free life about bequeathing the house after death.

Pay off all your loans before retirement

Honestly, do you want to enjoy time with your family and friends after retirement or work with banks and lending firms to slash debt? All of us will choose the former and hope to spend quality time lounging around with a book or catching up on favorite TV shows. Any financial advisor you talk to for suggestions on savings for retirement will advise you to sit with your banker or mortgage lender and start closing all your loans from the time you are fifty.

How to Improve your net worth?

Eliminating credit card debt and reducing your loans will improve your net-worth, though you may not get the income tax deductions. If at any time after your retirement you do need to borrow cash, this credit worthiness will help clear loans and give you the required cash when you really need it. The peace of mind you would get after getting rid of all loans cannot be ignored as it also improves the cash flow in the house.

Excited about clearing off all loans before retirement? Easier said than done, as getting the cash to do that can be really tough in a stagnant economy. However, do not lose heart and set milestones, which you can reach with minimal stress and tackle each loan one at a time to have debt free retirement.

Take help of your financial consultant to get rid of your debt if you are nearing your retirement.